Ghana Priorities: Industrialization

Technical Report

Intervention 1: Set up an integrated Bauxite Authority to Facilitate the Processing of Ghana’s Bauxite into Alumina and its Conversion into Aluminium ingots using the VALCO Smelter

Ghana's economic performance has been less than stellar since the introduction of oil. Growth increased to 14% in 2011 (largely jobless growth) and since then growth has been less than desirable partly blamed on the huge infrastructural deficit and the limited fiscal space. With limited fiscal space to inject growth through increase infrastructural spending, the country has stepped up its effort to utilize her natural resource deposit. The Ghana Integrated Aluminium Corporation (GIADEC) was established in 2017 by an act of parliament whose responsibility was to promote and develop the integrated aluminium industry. The following year government of Ghana concluded a USD 2 billion Master Project Support Agreement (MPSA) with Sinohydro Corporation Limited, a Chinese based company to support priority investment infrastructure projects in the country and the subsequent establishment of GIADEC. This development has to some extent divided the country with activists raising social and environmental concerns. This paper sought to shed some insight on the development using the costs-benefit approach to ease the concerns the various stakeholders may have with the financial and technical support of the Copenhagen Consensus Center

Implementation Considerations

Costs and Benefits

Costs

In the analysis of costs, the total costs of the Integrated Aluminium Industry (IAI), various controllable and uncontrollable factors such as production volumes and costs of raw materials were factored, resulting in 27 scenarios. These scenarios yielded annual total costs that ranged between $1.02 billion and $3.2 billion for the entire IAI. This is composed of costs for mining bauxite which ranges between $122 million to $523 million at various levels of production. The costs for alumina production ranges between $540 million and $1.6 billion. Similarly, costs for aluminium production ranges between $360 million and $1.07 billion at various levels of production. These costs are inclusive of investment costs which are annualized over a 50-year lifetime.

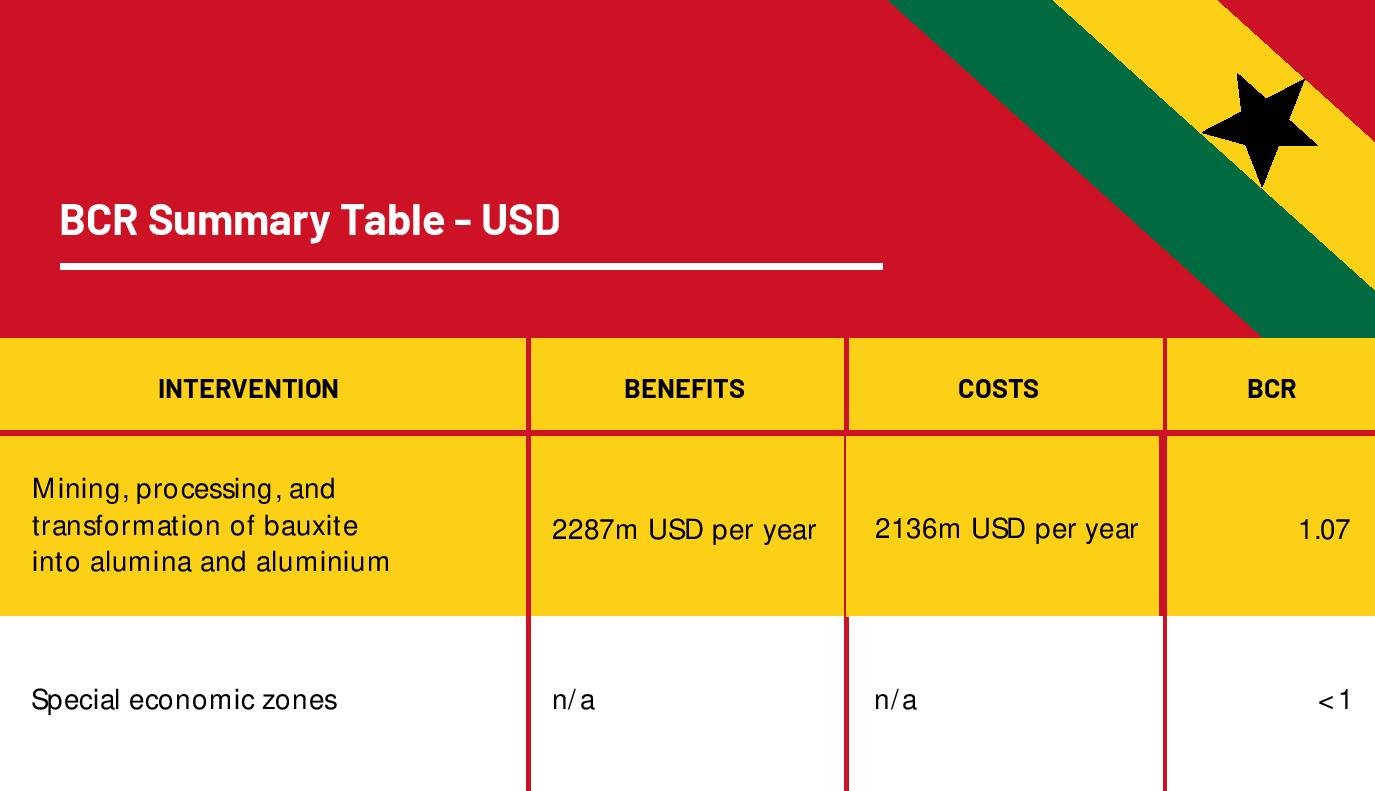

The median cost of all 27 scenarios for the entire value chain is 2.1 bn USD per year.

Benefits

Analysis of total benefits also yielded about 27 scenarios based on a similar controllable factor of production volume but with a different uncontrollable factor which is the market price of the commodity. Total benefits ranged between $934 million and $3.6 billion, with a median value of $2.3 billion. The average benefits for bauxite production range between $35.5 million and $284 million under different production levels. Benefits in alumina production range between $320 million which can increase to $1.8 billion and that of aluminium production lies between $583 million and $1.5 billion, given their production volumes. Given the various cost estimates, the net benefit for the entire IAI ranges between -$365 million to $560 million, with an average benefit of $140 million, representing an average benefit-cost ratio of 1.05 which is about 0.24 percent of Ghana's GDP.

The analysis argues that given the proposed volumes of alumina and aluminium production, a minimum production of aluminium curtails the problem of limited value addition, reducing the volume of exports of raw bauxite. Importantly, this estimate does not include difficult to measure flow-on effects such as direct and indirect employment, and technological transfers. Additionally, it does not include social, economic and environmental costs associated with the destruction of the natural environment and livelihood of the affected communities required to the mined bauxite.

Intervention 2: Use of Specialised Economic Zone in Ghana’s Industrialisation Drive

Free Zone concept or Specialised Economic Zones has long been recognised in the development literature as part of market-oriented, institutional, structural and economic reforms. Africa and Ghana for that matter embraced the concept a couple of decades given the failure of the import substitution pursued right after independence. Conceived then to attract export-oriented firms and facilitate trade, attract foreign direct investment, aid technology transfer and boost domestic private sector competitiveness with the end goal spurring economic growth and development. Against these theoretical and hypothetical benefits, empirical evidence has been mixed and heavily driven by data from developed and emerging markets. Available evidence on Africa generally and Ghana for that matter does not validate the hypothetical benefits. Costs show up in the form of host governments giving vastly generous trade incentives or subsidies or broadly tax expenditures to export-oriented firms (fiscal losses) and other hugely initial investments and several guarantees including vast lands. Benefits have included volume increase in export, foreign exchange earnings, income taxes, employment, the attraction of foreign direct investment, technology transfer and the generation of 2% of the global employment, etc. Enormous as this may be in nominal terms the question arises whether the share of the 2% of global employment from SEZs is justified in the face of the sacrifices the countries have to be made as well as the geographical distribution of the employment creation especially concerning developing countries such as Ghana. The theoretical benefit from SEZs hinges on the country meeting basic infrastructure requirements. To that extent, it would be prudent for the country to utilise her limited fiscal space to open up the entire country and reduce the huge infrastructural deficit which imposes further restrictions on the growth driers of the economy. Emerging evidence support the fact that countries are shifting policy from SEZs to creating the enabling business environment and improve economy-wide efficiency for the private sector to thrive. In the current form, the evidence points heavily towards concentrating limited resources to economy-wide reforms rather than geographically delimited areas within which governments facilitate industrial activity through fiscal and regulatory incentives and infrastructure support. It would be prudent for the government to utilise its limited fiscal space to open up the whole country, especially in terms of infrastructure, quality education and other incentives for all firms so that economic activity can freely take place in every corner of the country to realise balanced and more sustainable growth of the economy. Tax incentives on their own do not attract FDIs but other factors such as skills pool, availability of social and infrastructural facilities such as good schools, health facilities, road network, electricity, etc. may also count as significant considerations in investment decisions. Currently, the country loses hugely through tax expenditures which have been one primary means of attracting firms into the Free Zone enclaves and it does not represent efficient utilisation of the nation’s revenue. Ghana’s economy is predominantly SME based scattered all over the country and free zoning might only serve the interest of foreign firms rather than encouraging domestic private capital (domestic firms) to take such advantage though lately, the Ghana Free Zone Authority (GFZA) has been urging locals firms to relocate and take advantage of opportunities available within the enclaves. Several private-sector surveys including Ease of Doing Business, Enterprise Survey, Global Competitiveness Index and Country Private Sector Diagnostic (CPSD) point to many constraints that the concept of SEZs cannot address given the huge investment and tax expenditures associated with such intervention and even now that it is planned for every region (16) to have SEZs. The World Economic Forum's Global Competitive Index (GCI) in its report ranked Ghana 106 out of 140 countries predominantly on the back of poor infrastructure. On the readiness of future of production report (2018), Ghana needs to improve on its performance both in terms of the structure of production and drivers of production that requires broad-based investment in both hard and soft infrastructure among other interventions.